Beyond Stocks and Bonds: The Allure and Complexity of Managed Futures

- Modelist

- Jun 20, 2024

- 4 min read

Managed futures, Commodity Trading Advisors (CTAs), and systematic trend-following funds are investment strategies that:

Trade in futures markets across various asset classes (e.g., commodities, currencies, bonds, stocks).

Use quantitative models to identify and exploit price trends.

Can take both long and short positions.

Aim to profit from price movements in either direction across multiple markets.

These strategies typically use computer programs to make trading decisions based on price movements, aiming to capture gains from both upward and downward trends in global markets. For simplicity, we will refer to these strategies as CTAs throughout this article.

CTAs originated 50-60 years ago as high-fee hedge fund vehicles available only to wealthy, qualified investors. They performed extremely well in the 1970s, a period characterized by large, persistent trends in financial and commodities futures. However, their returns have been more mixed in recent decades. This inconsistency arises because the strategy relies on asset trends to generate profits, but markets don’t always trend, and good CTA returns tend to cluster in multiyear streaks.

Over the last fifteen years, this strategy has become readily available to retail investors at much lower fees via ETFs and mutual funds, pioneered by firms like AQR. But are these funds worth adding to a client portfolio?

If you are already including alternatives in client portfolios and do not consider CTAs a pure substitute for traditional stocks or bonds, CTAs can be a worthwhile portfolio allocation. Unlike some other alternative strategies, CTAs do not have a fancy name or hidden beta to traditional asset classes. Their performance is relatively easy to explain to clients: as long as there are some market trends, CTAs will make money.

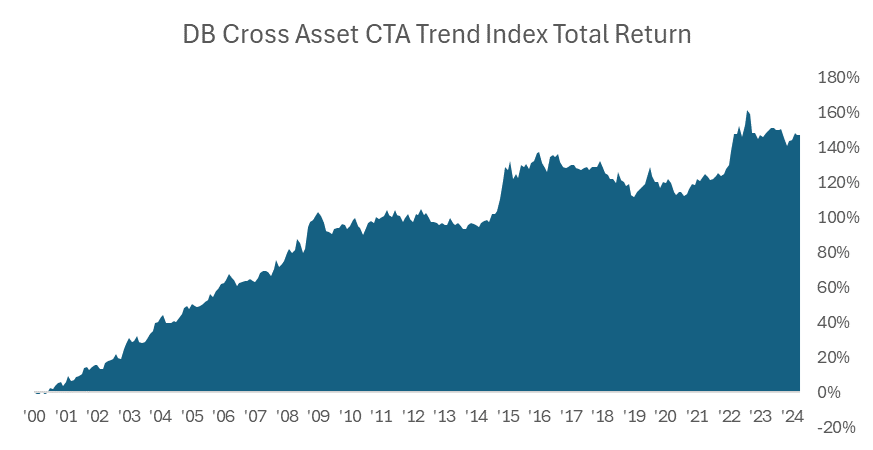

From a theoretical perspective, CTA mutual funds and ETFs look very attractive, offering long-term positive expected returns with low or even negative correlations to traditional asset classes. If you are constructing a portfolio, this is a dream come true. Below are the correlations of common alternative asset classes (including the DB Cross Asset CTA Trend Index) to both stocks and bonds over the past 20 years.

Here are the 3, 5, and 10-year returns of stocks, bonds, a CTA index, and a portfolio that is invested one-third in each. The absolute returns of the CTA portfolio can’t rival stocks, but the risk-adjusted and absolute returns of simply adding CTA returns to stocks and bonds are impressive. Over ten years, the Equal Weight stocks, bonds, and CTA portfolio had the highest information ratio.

Disadvantages

First, returns can be inconsistent. CTAs perform well over longer-term time frames but can also have periods of underperformance. The last 10 years have been good for CTAs, while the period from 2009-2015 was positive but underwhelming.

Second, CTAs do not offer a 1-for-1 substitute for traditional asset classes, complicating asset allocation. They should not be thought of as substitutes. In the 1970s, CTAs would run their portfolios at 25%+ annual volatility, much higher than stocks. Those days are long gone. Since 2000, the volatility of stocks, bonds, and a CTA Index places CTAs in a nether land between the two traditional assets.

Additionally, you can’t invest directly in the index, and there is a huge variation in the returns and volatility of available CTA ETFs and mutual funds. Unlike small-cap value managers, where volatility is in a tight range, CTAs show little uniformity. Should one invest in the annual 5% or 27% vol fund? It's confusing.

Selecting a CTA ETF or Fund

Assuming you believe CTAs will perform well going forward and recognize their clear portfolio value-added from a diversification and risk-adjusted returns perspective, how should you pick a CTA ETF or mutual fund?

We suggest selecting a fund based on the level of risk in the portfolio you aim to replicate. If it’s a stock-only portfolio, then a fund in the 15%+ range makes sense. For a conservative, fixed-income-only slot, choose a fund that is 7% or lower. For a 60/40 portfolio, select a fund closer to 10%. The allocation percentage should be client-specific but likely aligns with what you would normally choose for alternatives in that portfolio.

Conclusion

To be frank, we don’t know how CTAs will perform in the future. These vehicles have the advantage of being able to go long and short. CTAs tend to do well in recessions, market crashes, and when large macro drivers push prices in the same direction. They are a good way to gain commodity exposure. Obviously, if the equity bull market continues indefinitely, their returns will not look as good compared to stocks. That said, we believe CTAs are among the most compelling alternative investments available to retail investors. They are uncorrelated with traditional asset classes, are excellent diversifiers, and their performance is understandable, though not predictable.

Data Sources: Bloomberg, YCharts

Make the most of these insights using Modelist. We create customized investment models for the fiduciary financial advisor. Get in touch with us at hello@modelist.me for a personal consultation.

Modelist Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.