Dollar Downshift: The Forces Behind the Fall

- Modelist

- Jul 23, 2025

- 4 min read

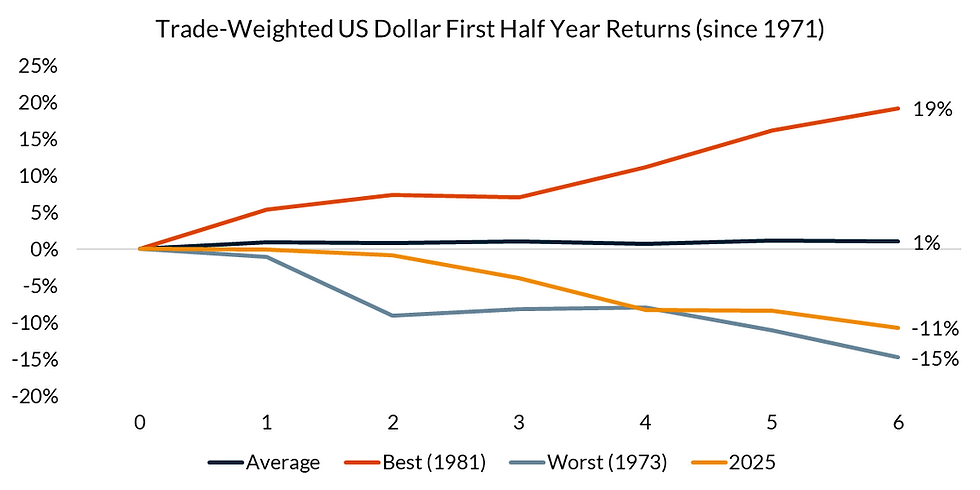

As of the end of June, the US dollar, on a trade-weighted basis, has experienced its second-largest decline since 1973, when the Bretton Woods system was dismantled and currencies began floating freely.

Breaking down the decline by currency, it's evident that the largest contributors have been European currencies and the Mexican peso. China, whose capital account remains closed and thus does not operate a fully floating exchange rate, has likely managed its currency to prevent appreciation and maintain export competitiveness.

This decline can be attributed to a mix of three long-standing forces that have historically influenced the dollar’s direction. Each of these forces has shifted meaningfully over the past six months. Let’s break them down:

1. National Savings / Current Account Deficit

In general, countries that don’t save enough tend to see their currencies weaken over time. If a country undersaves, whether due to high household consumption or excessive government borrowing, foreigners must step in to lend or buy domestic assets to bridge the gap. This imbalance is reflected in the current account deficit.

In the US, the current account deficit currently stands at roughly -4.5% of GDP. Over time, this persistent shortfall is a structural force that puts long-term downward pressure on the dollar.

2. Relative Returns

Currencies tend to appreciate when investors expect higher relative returns on assets denominated in that currency. This can happen in two primary ways:

If Country A has higher growth or more attractive investment returns than Country B, it attracts foreign direct investment or portfolio inflows. US equities have outperformed non-US stocks for more than a decade, helping drive capital into the dollar.

Likewise, if short-term interest rates in Country A are 5% versus 1% in Country B, capital flows to Country A to capture the yield spread, commonly known as the carry trade.

Today, however, Fed Funds futures are pricing in a 125 basis point cut in US short-term rates over the next 18 months. For the past decade, the dollar has benefited from stronger equity performance and higher yields relative to other developed economies. That tailwind may be fading.

3. Safe-Haven and Reserve Currency Status

Some countries, like Switzerland or, at times, Japan, run current account surpluses and are seen as stable destinations for capital in times of global uncertainty. The US has historically enjoyed this status too, largely due to its role as issuer of the world’s primary reserve currency and the fact that most global trade is priced in dollars.

In periods of global stress, capital typically floods into the US dollar. But cracks in this perception are emerging.

Putting It All Together

Since the 1980s, the dollar has been pulled between:

A long-term downward force: the current account deficit, which reflects chronic undersaving and a reliance on foreign capital.

Two offsetting upward forces:

Strong relative returns on US assets (stocks and bonds)

The dollar’s role as a global reserve currency and safe haven

Now, a new administration has brought a new set of priorities. Chief among them is reducing the trade deficit, which is the largest component of the current account. There is also an implicit policy goal of weakening the dollar to boost exports and domestic manufacturing, which currently makes up just 10% of GDP.

So, how have the Trump administration’s policy shifts and recent market developments affected these three key drivers?

National Savings / Current Account Deficit

Aggressive tax cuts and higher government spending are projected to add trillions to US debt over the next decade. This worsens the national savings gap and adds more downward pressure on the dollar.

Growing concerns over fiscal sustainability, combined with unpredictable trade rhetoric accusing foreign partners of “ripping off” the US, have dampened foreign appetite for US assets, including Treasuries. This makes it harder to finance the current account deficit.

Relative Returns

US equities have underperformed overseas markets year-to-date. After years of US outperformance, global investors with historically high allocations to US assets are now rebalancing away from the dollar.

Expectations of Fed rate cuts are reducing the attractiveness of US yields versus other developed markets.

Safe-Haven and Reserve Status

Unpredictable tariffs and trade decisions have eroded global trust in the US as a stable trading partner. Retaliatory fears and trade disruptions have unsettled markets.

Political pressure on the Federal Reserve has raised concerns about its independence. This undermines the dollar’s credibility as an apolitical safe haven.

Several countries have signaled a desire to conduct transactions in currencies other than the dollar. Rising gold prices and demand for European bonds suggest global investors are looking for alternative hedges and safe havens.

In Summary

The so-called “Big Beautiful Bill” may worsen both the US savings rate and the current account deficit, further pressuring the dollar. With interest rates likely headed lower and US equities underperforming, the relative return advantage of the dollar is fading. Meanwhile, “America First” rhetoric, erratic trade moves, and political interference with the Fed have dented the dollar’s safe-haven appeal.

Put simply, the forces putting downward pressure on the dollar have grown stronger, while the traditional supports—attractive returns and reserve currency status—are weakening or reversing.

That might sound alarming, but it’s not all bad news. Sure, your €2 espresso in Rome now costs you 15% more, though it’s still only a third of what Starbucks charges. But if you own unhedged foreign stocks or bonds, the dollar’s decline may have added 10% to your returns. Being a tourist abroad just got pricier, but your overseas investments got a nice tailwind.

Make the most of these insights using Modelist. We create customized investment models for the fiduciary financial advisor. Get in touch with us at hello@modelist.me for a personal consultation.

Modelist Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.